2024 Irs Schedule C – There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .

2024 Irs Schedule C

Source : carta.com

Budgets 2 Goals | Baton Rouge LA

Source : www.facebook.com

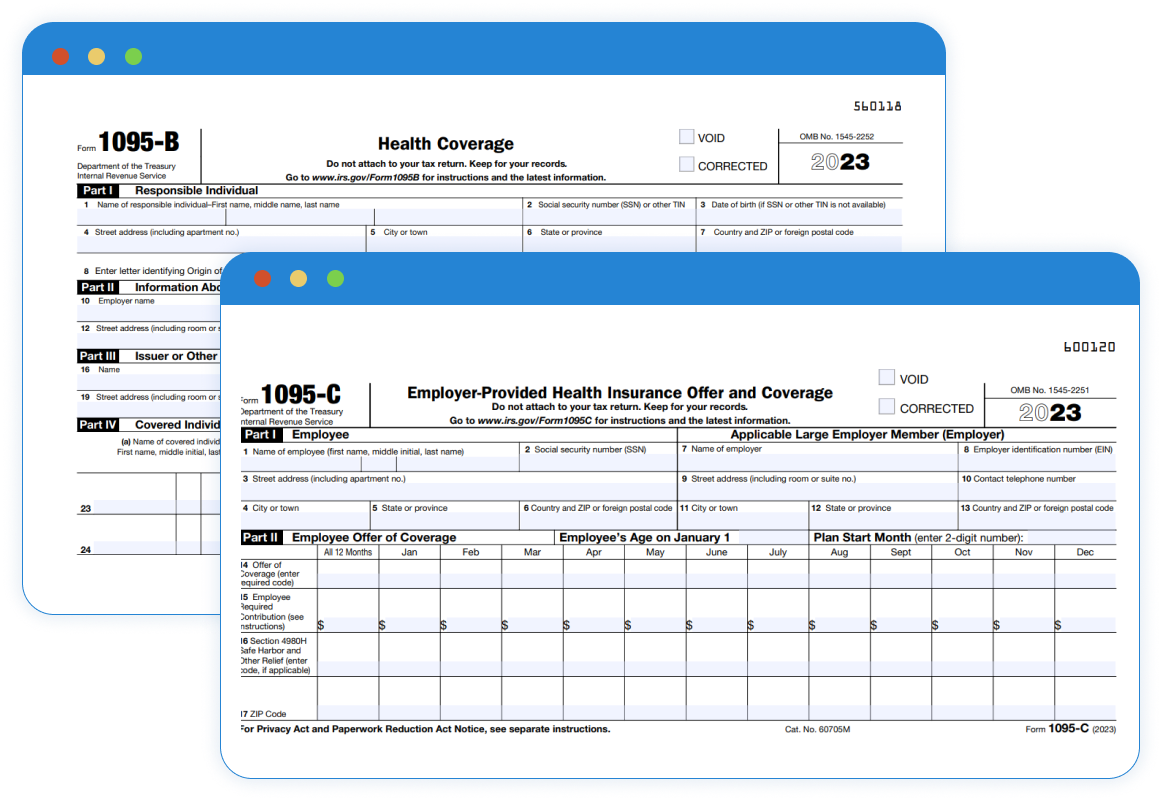

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

Safe Harbor Bookkeeping DFW

Source : www.facebook.com

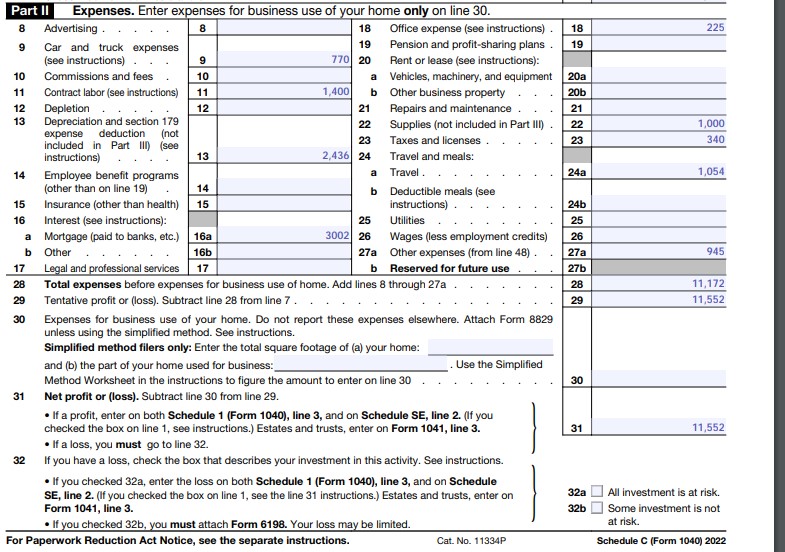

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

M & J Services | La Villa TX

Source : www.facebook.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

Here’s who qualifies for IRS’ free ‘Direct File’ pilot program in 2024

Source : www.cnbc.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

2024 Irs Schedule C Business tax deadlines 2024: Corporations and LLCs | Carta: From TDS deposit to TDS/ TCS certificates and challans to advance tax to audit report; here’s the complete list of activities you should complete in December . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .